Streaming Blood: Can Warner Brothers Discovery (WBD) Stanch the Flow?

Photo via Bing Image Creator

NETFLIX’S data reveals A Fundamentally flawed Business Model

Betting against streaming giant Netflix probably remains pointless. But understanding how pointless streaming media has become, is anything but. Netflix may be doing so much streaming that it has gone completely out of its mind. But exploiting that lapse is probably not wise. Much more actionable are the media companies facing the same challenges, but without the scale of Netflix. For that, the pick is Warner Brothers Discovery (WBD) and its unit HBO.

Starting in June 2021, just like any normal media company, Netflix released fungible performance data for its top titles. Anybody can now study the current list of the 41 most popular titles of all time; the 4,100-or-so most popular global weekly titles; and the long list of over 196,000 weekly Top 10 titles, for nearly 100 countries and territories around the world.

Netflix makes data on its top-performing assets surprisingly easy to study. It’s about time.

This is still Netflix. Its data is as idiosyncratic as its shows: Reported “views” aren’t the number of times a show has been viewed. Rather, for Netflix, “views” is the ratio of total hours the title was viewed divided by the runtime for that title, which essentially captures how efficiently a show gathers its audience. The Top-10 data is strictly limited to the first 91 days of release. What actually happens deeper out among the full list of roughly 6,600 titles usually available on Netflix remains hazy. And various seasons of a show are counted as independent properties: Mega-hits like Stranger Things and Money Heist make list after list. The front edge of the viewer palette is probably smaller than Netflix would like to admit.

Still, for those of us who have tilted at the analytic windmills of this most barmy of tech unicorns, Netflix’s simple well-structured datasets are an invaluable peak at what the streaming media business actually is, and not what it merely hopes to be.

Considering Billions of Views

What’s immediate – and startling – in Netflix’s viewer data, is the gaudy dominance of its top-line multi-season franchises. The combined viewerships of Stranger Things, Squid Game, and Money Heist gave up nearly 7 billion (!) hours of their lives viewing these shows in just 91 days. Such is the magic of nearly 200 million subscribers:

Have roughly a quarter of them engage, and you’re creating attention that would thrill the Vatican.

But it’s also evidently clear of the effort required to create such bankable multi-show events. Of the top-10 most-viewed titles, all but 3 are standalone films. Red Notice, Don’t Look Up, and The Adam Project reached a combined 1 billion views, but they did so in about a third of the combined running time of multi-season hits like Stranger Things.

The prospect of cranking out 13 hours of Stranger Things feels pretty shabby compared to creating just 120 minutes of Bird Box, the surprisingly taut Sandra Bullock/John Malkovich futuristic thriller.

What’s surprisingly chilling is how quickly Netflix’s audience flees from its properties. Over the first 91 days, the second all-time leader in views, Wednesday: Season 1, drew a reasonable 5.2% less than the Squid Game’s most-seen 265.2 million views. But the 4th place disaster pic Don’t Look Up drew nearly 35% less than the 3rd-place Dwayne Johnson action romp Red Notice. And the least viewed property in the top list, Elite: Season 4, drew just 46.3 million views, or just 17% of the most viewed show.

Yet stranger things lie in the larger list of roughly 4,100 weekly Top 10 shows. Here the single, all-world champion is not a mega-hit like Bridgerton or Extraction but a lovely Colombian telenovela, Yo Soy Betta, La Fea, a well-meaning, romantic drama that spent nearly 30 weeks in the top 10. The only English-language franchise to have anywhere close as loyal an audience was a single season of Manifest, a 2018 plane-crash epic that quite honestly took us some effort to engage in.

We probably fly too much.

In the aggregate, Netflix Top-10 data is scarier still: On average, its most successful shows only lasted in the top 10 for 3.25 weeks. Many prominent properties could only manage a top-10 performance for a single week: Venom, Viking Valhalla, The Umbrella Academy, the original Top Gun, all four Twilight Sagas, and two Hunger Games films were all one-week wonders on Netflix.

Of nearly 4,200 Top 10 Netflix titles, only a handful remain in the Top 10 for more than 16 weeks. Almost none are known franchises like Stranger Things or Squid Game.

In fact, of the roughly 4,200 individual shows reported in the weekly top-10, nearly 1,460 of them were only in the list for one week; just over 970 could attract a major audience for 2 weeks and only 320 or so could hold on to an audience for a month. How many shows of the 6,600 Netflix shows could stay popular for 12 weeks? Only 25!

Netflix’s viewing trends take on a positively apocalyptic edge when the full list of 192,280 Top-10 titles are reported for over 100 countries and territories. A full 73,500 titles survived just one week in the top-10. 13,400 made it to 4 weeks. Just 970 -- or one half of one percent -- could hold a Top-10 audience for a full 3 months.

No disrespect to Yo Soy Betta, La Fea – a show we genuinely liked – but where are the Star Wars- or Toy Story-scale franchises in Netflix's top performers that build the deep bonds with audiences that drive value?

Web streaming may finally be revealing itself for what it is. The prospect of offering massive libraries to even more massive audiences leaves no room for a Luke Skywalker or a Buzz Lightyear.

Scale doesn’t excite viewers, it overwhelms them.

The Downside at Warner Brothers Discovery

Back to Warner Brothers Discovery. Its performance data tells the same story of audiences all too eager to scatter.

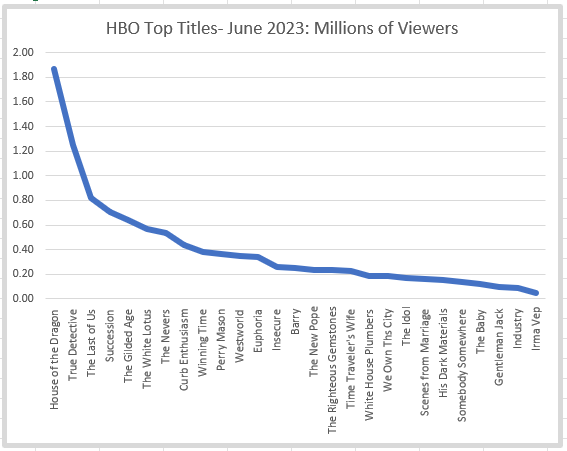

In June of 2023, its top-rated House of Dragons reported a decent 1.8 million total viewers, particularly among the young. (For the record, the original Game of Thrones reported more than 11.8 million viewers.) But work your way down through the top-26 HBO shows reported, and Perry Mason’s 360,000, Barry’s 234,000 and Somebody Somewhere’s 140,000 viewers feel just as thin as Netflix’s.

HBO’s audience loses interest in its top hits, just like Netflix’s.

Warner Brothers Discovery is the media company that in 2022 featured operating losses of just under 50% of total revenues. It burned $12 billion in content rights to create more $7 billion in net losses. There was the incomprehensible balance sheet narrative: the firm reported $26.6 billion in total film and TV content assets in 2022, which grew from just $3.1 billion in the previous year. And the nearly $36 billion of that was booked as goodwill. We still don't get it.

We’ve been told the operation is making changes. It’s cutting back on its debt load. It is rebranding. It released a terrific streaming app called Max, which essentially offers the entire Warner Brothers and Discovery archive. We can report that unlimited access to both Anthony Bourdain and Larry David was enough to let our Netflix subscription lapse.

But sellers have been outstripping buyers of Warner Brothers Discovery stock since 2021. Nothing appears to be changing the reality that trying to tell every story to everyone, is the same grim business of merely telling just one story to anyone.