The Held-To-Maturity Trap: Lakeland Bancorp Vs. Camden National

Photo by Pixabay via Pexels

subtle accounting treatments can have powerful effects on troubled banks

NEW YORK CITY — Here’s a quick, but useful, note on how banks manage their accounting. Since the illogical and probably self-inflicted collapse of Silicon Valley Bank earlier this year, investors have found themselves wading through bank balance sheets sniffing for trouble. Results have been feeble. Is there really way to compare balance sheet items like “non-owner occupied loans” at mid-Atlantic bank Lakeland Bancorp (LBAI) to the “commercial loans” issued by a northeast lender, like Camden National Corp (CAC)?

Keep in mind, the commercial loans from Camden National include billions lent to fishing vessels. The bank funds one of the largest lobster fleets on the planet. Lakeland, on the other hand, rode the 1960s New Jersey commercial real estate boom.

What’s the relative risk of a Jersey mall to a 44-foot offshore lobster boat?

Nomenclature for how banks lend has emerged as key to proper valuation. Bank accounting is tricky. Bank loans are the assets. The deposits are the liabilities. The ratio between the two – that is, the “loans-to-deposits” – is the key indicator.

The higher the ratio, the weaker the bank. Anything higher than say, 85 percent loans-to-deposits and it’s time to do some homework. Major financial institutions like JP Morgan Chase and Wells Fargo took early note of today’s weakening economy. Both reduced their loan-to-deposit ratios from about 60 percent in 2019 down to around the mid-40s in 2022.

Low loans-to-deposits are why major banks stocks are trading at 52-week highs.

Regional banks were more aggressive during the softening economy. Loans-to-deposits were higher. Banks were more fragile. Camden National, for example, fixes its loans-to-deposits at basically 80 percent. Lakeland Bancorp wobbles around from 85 to 96 percent. Most banks fit somewhere in between.

But the recent round of central bank lending rate increases forced a subtle — but profound — change in the accounting for loans-to-deposits. Bank assets can be accounted for in basically 2 ways: Securities are either available-for-sale and or they are held-to-maturity. Available-for-sale assets are usually shorter-term loans that can be sold at any time and must be valued at current market rates.

Assets held-to-maturity, on the other hand, are usually longer-term loans. They stay on the books until they are fully paid off. They spend their financial lives on the balance at their original cost.

During easy times, when money is cheap and inflation is low, the difference between the value available-for-sale assets and those held-to-maturity is just nickels and dimes. But when times turn tough, and money gets pricey and inflation heats up, available-for-sale assets tend to devalue, held-to-maturity assets don’t.

The effect on valuation can be enormous.

Camden National Bank, for example, plumped the $1.2 million it booked in held-to-maturity securities in 2021 to a truly enormous $546.4 million in such assets in 2022. Lakeland went from roughly $90 million in held-to-maturity assets in 2020, to over $923 million such assets in 2022. Many other banks followed.

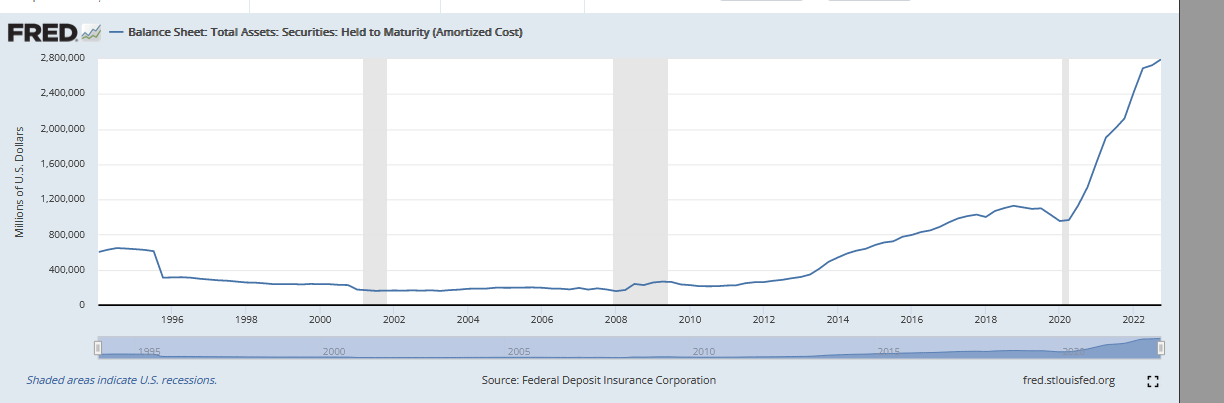

Federal Reserve data indicates held-to-maturity assets reached an all time high of nearly $2.8 billion on American banks’ books.

Federal Reserve data indicates that held-to-maturity closed in on a record $2.8 billion, or basically 10 percent of total assets, available to commercial banks.

But reliance on held-to-maturity assets comes at a steep cost. Once that loan is designated to be held to its maturity, it must be held essentially for its full term. Meaning those assets are not available to the bank in case a run on deposits or liquidity needs or other emergency.

And the lack of liquidity from held-to-maturity assets can have a dramatic affect on the ratio of loans-to-deposits and the health of the bank. Camden National’s held-to-maturity assets run at roughly 10 percent of total loans. But Lakeland’s held-to-maturity assets close in to closer than 12 percent.

Camden National’s loans-to-deposits ratio was a reasonable 85 percent in 2022. Lakeland’s was a not-so-reasonable 91 percent for the same year. Meaning banks with higher held-to-maturity assets like Lakeland are more risky then they initially appear.

And banks with fewer such assets, like Camden National, are a bit less.