Flying High: Air Transport Services Group (ATSG)

Image: Courtesy Rhenus Group.

Web retail is restructuring global shipping AS flashy Air freight firms face headwinds

It remains up in the air (pun intended) how many pilots and planes this wee global economy of ours truly needs. Certainly commercial passenger carriers like United Airlines are managing record pilot onboarding. The airline reported one of its highest-ever months for hiring. Aircraft manufacturers, too, announced deep demand. At the recent Dubai Airshow, held at the world’s newest airport – Al Maktoum International – both Boeing and Airbus blithely forecast planes to sell well into the 2040s. Take that, the Internet.

But widen that aviation narrative to include other planes that fly packages and not merely people, and the flight plan for air freight is finding it darn tough to get wheels-up.

This fall, citing reduced demand, overnight carrier FedEx began directing its pilots to seek employment elsewhere, in particular smaller regional airlines. FedEx pilots rejected a company contract and called a round of company dividend payments as coming ”straight from FedEx pilot’s pockets.”

United Parcel Service also rolled back pilot ranks, citing a slowing air freight market and an uncertain economy. Miami-based regional cargo specialist Amerijet International joined the bigger air carriers in laying off about 12% of its workforce in the face of falling air shipments in the Americas and the Caribbean. Of note, the pilots that remained won a 40% increase in salaries. The pilots have a strong union, it appears.

Canadian air-freight hauler CargoJet also quietly announced it will be selling off some older, less efficient freighters and reducing conversions on smaller passenger planes. Shipping pilot and equipment woes are not limited to legacy aviation carriers. The angry new kid on the air freight block, Amazon, is facing a major pilot strike from its air-freight outsource company, Air Transport International. Lagging pay and declining safety practices are the drivers there. (Much more on Air Transport International in a moment.)

Airfreight retrenchment is not limited to the U.S. The Civil Aviation Authority of Bangladesh reported rollbacks in airfreight shipments. In Australia, disruptions in a logistics software created a mini supply shock at Qantas Freight. And analysts are expecting the freight and logistics sector in far flung markets, like the Middle East, to wane over the coming year.

How aviation can have not enough pilots and planes to fly people and too many to fly packages, is a tricky question to navigate.

When More Is Less

Historically, a pilot’s fortunes followed the world’s. In 2000, United Parcel Service needed about 2,350 pilots to capture $29.5 billion in revenues. By 2022, that pilot cadre grew to more than 3,485 flyers to capture revenues of about $100 billion.

Historically, the number of air freight pilots reflect overall company revenue.

But flying is not always lucrative: In 2006, many pilots found themselves grounded as the 2009 recession loomed. It took nearly ten years -- or well into 2018 -- for the pilot workforce to grow past its 2006 peaks.

By a wide margin, most inside the shipping industry -- which includes not only airfreight but containers, and overland transport -- say today’s airfreight pilot woes is merely history repeating itself. A looming recession in 2024 and post-pandemic restructuring is supposedly eating into shipping demand.

But what exactly is the status of that coming 2024 recession? If early holiday sales data is to be credited, a deep and prolonged slowdown is not imminent. Black Friday retail sales grew by a robust 4.8% percent this year over last. For those sales to be booked, real goods must be shipped to real people and airfreight, in turn, should be growing.

This year’s retail sales growth is also finding its way into traditional sellers. Best Buy, Macy’s, Kohl’s as well as the overall category of Outlet Malls, saw Black Friday human traffic surge more than 400% (four hundred percent) over previous weeks of the year.

That demand wasn’t just for splurge items, like electronics or clothes. Mid-sector bellwethers, The Home Depot and Lowe’s, both saw Black Friday foot-traffic jump more than 90%.

Brisk economic activity drove a retail foot-traffic surge, this past Black Friday.

The shipping containers, that deliver much of these goods, have become such flexible and adaptable structures that there’s increasing demand for these modules as a form of housing. Those who want to ship in a container now must compete with those who want to live in one.

The U.S. Department of Transportation, estimated in its 2023 Supply Chain and Freight Indicators, overall monthly capacity of containerships flowing into all US ports was up, compared with both 2022 and 2021. And those goods flowed off these containerships at ever more efficient rates. The number of vessels anchored off both the Eastern and Western U.S. ports dropped from more than 50 in 2022 to down below 10 in the early 2023.

Demand appears to be meeting supply, when it comes to containers.

Supply chain shocks seem to be in the past. The number of container ships waiting to unload has dropped to zero in some American ports.

While there are downtrending stories in how containers move, with overall traffic in some ports being down and costs rising, the notion that economic disaster is looming is hard to defend.

Something else appears to be disrupting the demand for airfreight pilots and planes. And like many other markets, the disruption is coming from the Web.

Prime Supply Chain

Starting in September 2023, Amazon formally brought to market a service it has passively offered for decades: Supply Chain by Amazon. Starting at $39.99 a month, the web giant offers low-cost access to subscription logistics services, integrated tracking technologies, on-web promotions, transparent costs and 2-click access to global ocean freight services.

In September, Amazon announced low-cost access to its global supply chain and ocean freight network. For $39.99 a month, subscribers can operate a logistics platform with reach around the world.

New subscribers get an 8% discount on container fees, which is basically a freight forwarder’s markup. Subscribers can now compete with larger logistics companies for expedited shipping container service that speeds delivery even from remote markets like China.

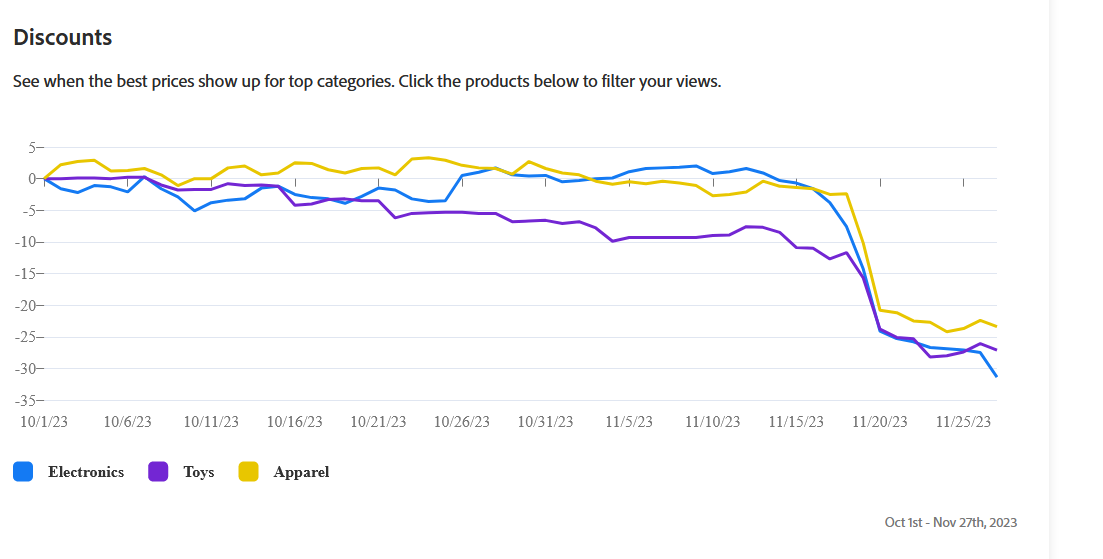

Early indications are Amazon has been effective in disrupting global logistics. Remember those robust holiday in-store retail sales? Holiday sales also hit brisk levels online. But the driver for those web purchases was discounting. Deep discounting.

Deep discounting drove deep web retail sales this past Black Friday.

Data indicates that price drops of 30% or more were to be had in some categories like toys and electronics. The cost cutting seems to have done nothing to affect Amazon’s profitability. Operating margins were up for the most recent quarter of 2023.

No one is arguing that air freight will disappear. Rather, the image that is emerging is that Amazon did not need to develop high-tech automated drones to compete with costly delivery services like FedEx and UPS. Rather it created low-cost access to cheaper container shipping to offer alternatives to airfreight.

And in the process, it reduced the need for the package carrying pilots and planes.

Winning the Supply Chain

Winners are emerging. We like the low-cost air freight providers that can ship goods at lower cost than name providers UPS, FedEx, and CargoAir. The ones that will do even better will have direct access to the web-based logistics tools, like those currently being developed by Amazon. Our pick is Wilmington, Ohio-based Air Transport Services Group (ATSG). On a recent company investor call, company CEO Rich Corrado laid out the company narrative for how it will provide flexible plane leasing options and cost containment that the emerging new supply chain will require.

Low-cost air transport leasing companies with the ability to adapt to Amazon’s new network will flourish. Air Transport Services Group is one of them.

Corrado manages a fleet of leased Amazon air freight assets. He runs the planes that are bolted directly into Amazon’s logistics tools.

It also does not hurt that the company equity is cheap. The ticker was battered over the past year as it faced strikes and contracting market share. Its $14 share price is about at its 52-week low. That spins just $1 billion market cap on $2 billion in revenue with an $8 price to earnings ratio and $19 per-share book value.

Because flying air freight might be bare bones, but investing in it will be first-class.