Bad Beat in Sports Betting: MGM Resorts International (MGM)

Photo courtesy Pixabay

competition, taxes, and High technology costs Squeeze margins for newly legalized online sports wagering operations

How does a large and successful casino operator lose money in the fast-growing market for newly legalized American sports wagering? Apparently, fairly easily.

Earlier this month, the Maryland State Lottery and Gaming Control Agency quietly disclosed that Las Vegas-based MGM Resorts International suffered a $3,811 loss during the month of February 2022. The loss was minute compared to the $7.51 million in wagers the sportsbook took in for the month. Still MGM, managed to lose that money in a period when the heavily bet Super Bowl was played.

MGM argued that the negative earnings stem from $18,771 in U.S. excise taxes due and the unexpected outcome of the Los Angeles Rams’ victory over the Cincinnati Bengals. Overall, for the fiscal year, MGM reported a taxable profit of $2.59 million.

State gaming officials added that poor performance by sports gambling operators was due primarily to the lack of online and mobile wagering in Maryland. The state’s legislature has been lagging behind nearby Pennsylvania, New Jersey and New York, in legalizing sports wagering for computers and smartphones.

Casino analysts confirm that overall mobile and computer-based sports pays. Sportsbetting.legal, a Tallahassee, Florida-based sports betting data aggregator, estimated that in January 2022 alone, New York State’s newly legal mobile sport betting service earned $112.8 million taxable net profit, and paid $61.2 million in taxes to the state.

However, an analysis of sports wagering in other states indicated bad bets may be in the offing. Pennsylvania’s Gaming Control Board reported similar losses in sports wagering for February 2022 for both combined in-casino and mobile wagering. The roughly dozen or so operators in that state reported a combined loss of $442,000 on $597.1 million in total bets.

The negative results included significant losses taken by seasoned sports handicappers like Harrah’s and Hollywood Casino.

February's poor performance is emerging as part of a larger picture of razor-thin margins throughout sports betting. In the year and half that Pennsylvania has reported figures, the percentage of taxable net income compared to total wagers taken has averaged just 3.9%.

Industry-wide estimates say that anywhere from 92% to 96% of all bets taken by sports book operators immediately flow back as prizes paid to winning betters. The remaining 4% to 8% in operating income is then further eaten into by a quarter-of-a-percent Federal excise tax and significant state levies. Pennsylvania charges operators a 34% tax. Maryland takes a more reasonable 15%. But some states, like New York, demand both a 51% tax rate and steep franchise fees and start up costs.

By some accounts, effective tax rates in New York for sports betting can touch 64%, or roughly double what the Sopranos, the fictional crime family, has charged for lending money.

Steep taxes and fees must then be factored into the increasingly steep costs of attracting betting customers. Sector leader DraftKings (DKNG) lost a stunning $1.5 billion for the full year of 2021 and $326 million for the three months ending in December of the same year.

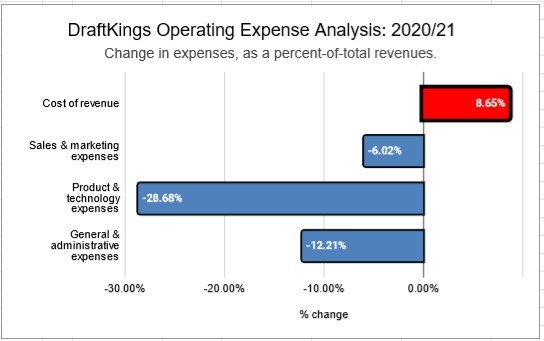

DraftKings annual statement of operations breaks down the causes for such negative earnings. Year-over-year costs in marketing, product development and administrative fees came down as a percentage of overall income.

Those efficiencies were offset by the increased costs of revenues. The company does not appear to disclose what those increased costs of revenues were, nor if those increased costs included offering riskier bets to attract new users.

“In general, our iGaming and Sportsbook product offerings produce revenue at a higher cost-per-revenue dollar, relative to our more mature DFS offerings,” was the clearest disclosure we could find on defining these increasing costs.

And it appears sports betting operators are behaving as if they’re operating in a profit-challenged sector. For example, the Maryland legislature granted 17 entities the right to enter the state-mandated qualification process for sports betting licenses. To date, 9 have completed the required background checks and operational readiness reviews. Only 5 have actually started taking bets. Some states, like New Jersey, are already showing declines in sports betting activity as stiff new competition saps demand from nearby states, like New York and Pennsylvania.

It’s Hard to Handicap Life

Major casino operators like MGM also face the overall uncertainty of a post-pandemic gambling business. MGM’s Las Vegas Strip property reported that its gaming win was down 14% month-to-month. The expectation is performance will improve as the pandemic wanes.

MGM’s troubles have as much to do with declining traffic at major properties, like the Las Vegas strip. But still, online gambling will be no easy bet.

Traditional operators have long argued that virtual betting will be a crucial growth area. MGM, Caesars Entertainment (CZR), and Wynn Resorts all have major pushes into online sports betting. As each seeks to open its doors in dozens uniquely managed state regulated markets, each faces increased costs, taxes, and technology fees.

It appears that newly legalized sports wagering is following the well-worn road pioneered by gambling entertainment cousins, in music, movies, and financial services. A lucrative gaming business firmly built on the flow of analog dollars is giving way to a virtual sports betting market floating on hard-to-manage digital pennies.

It’s probably wise to wait for better bets to emerge on humankind’s unstoppable urge to gamble.