Some fresh ideas we’ve been working on...

An Empire of Woe: BP PLC (BP)

Prolonged fighting over energy policy has actually created opportunities in the energy market. We drilled into America’s trade surplus in natural gas and found a vulnerable energy company: British Petroleum. Indeed, BPs future may be a bellwether for the entire sector.

A Tariff Winner?!: iberdrola (Spain: IBE)

Tariffs are getting tough to handle. But a closer look reveals that the White House’s complex tariff plans are nothing knowable reciprocal trade agreements. There will be unlikely winners, like a Spanish utility called Iberdrola.

Antidote to Election Jitters? CVS Health (CVS)

Pollsters are struggling with new respondent factors for gender, lineage, and political affinity. There will be opportunities for investors.

Gray Skies Are Gonna Clear Up: Swiss Re (SREN)

2024 was supposed to be a barn-burner for major cyclones. But activity -- and damage -- has been relatively light. Meaning reinsurance companies like Swiss Re should prosper.

AI Innovates Less Than You Think: C3.AI (AI)

Government data indicates that artificial intelligence has yet to harness efficiencies economy-wide. And if the history of disruptive digital technologies is any indication, that is not likely to change any time soon.

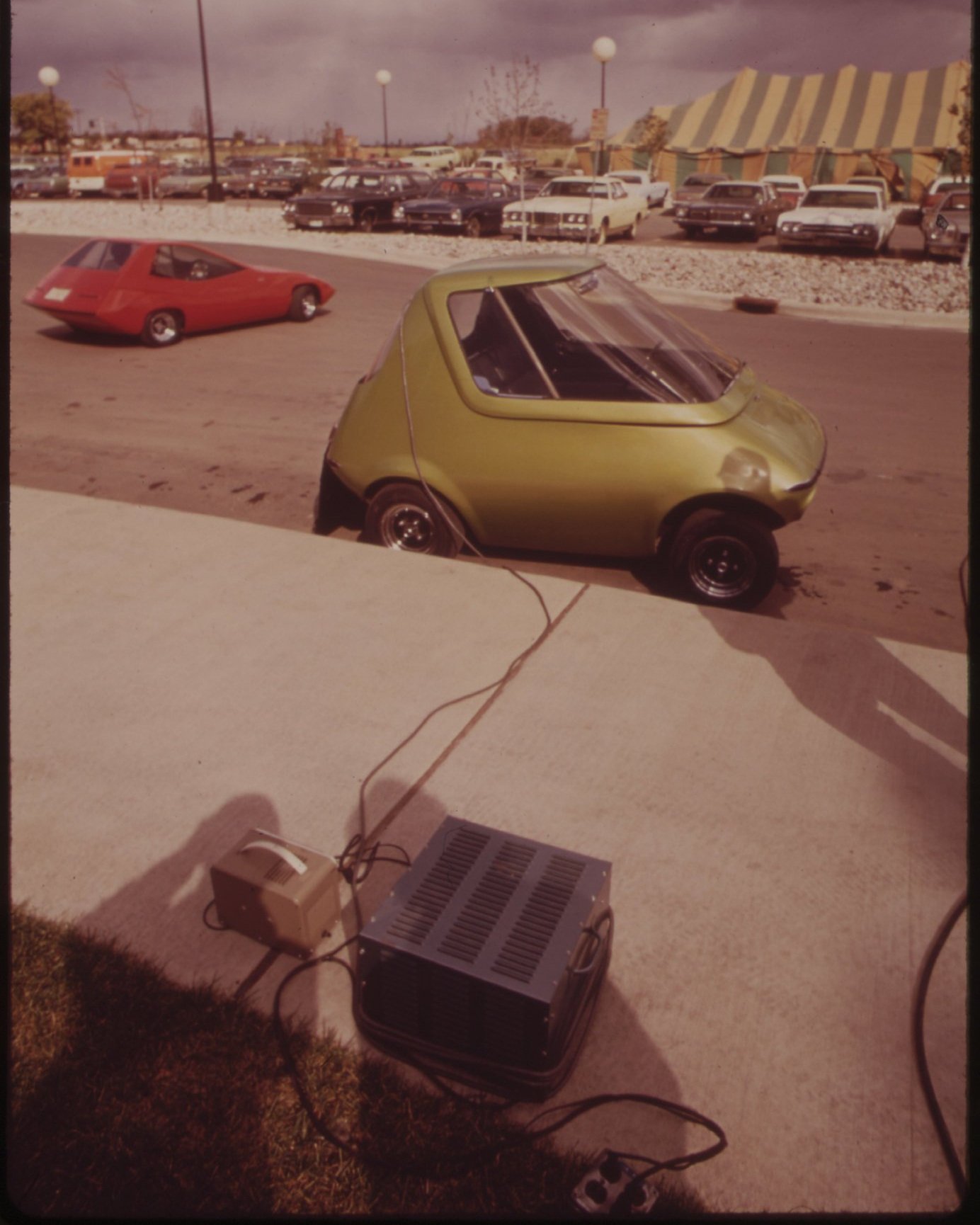

Charged With Possibility: Umicore (UMI)

It took an exhausting trip to Nepal to realize that corruption has become as critical to the global supply chain as capital and labor. How companies manage graft will absolutely affect the sourcing of the minerals needed for the batteries for electric vehicles.

Flying High: Air Transport Services Group (ATSG)

Last month Amazon opened its global supply chain to anyone with $39.99 a month. It will offer unprecedented low-cost access to complex logistics, like containers. Air freight giants will face headwinds.

SEC Crowns a New Crypto King: Liechtenstein Cryptoassets Exchange (LCX)

While U.S. regulators have cracked down in dozens of crypto startups this past year, European regulators have passed reasonable regulations. Euro-crypto firms will flourish.

Is TechTarget an Automated Bullseye? (TTGT)

Part writers, part marketers, part nerds, TechTarget has always been a favorite among story-driven geeks like us. Thing is, the company might just be cheap, right now.

Manufacturing a Recovery: RPM International (RPM)

Improvements in productivity and nimble managers may have solved supply chains woes and costly labor. Could the worst be behind us?

Macro Focus: Vive La Woke Française!

Civil unrest in France overlook an economy poised for a new world order.

Flying the Semi-Private Skies: Volato (SOAR)

Our sad broken airline network is opening the door to a new generation of semi-private airlines.

Urban Plunge: Will 622 Third Avenue Rise Again?

New uses are emerging for older commercial real estate.

Streaming Blood: Can Warner Brothers Discovery (WBD) Stanch the Flow?

New data from streaming media companies indicate a fundamentally flawed business model.

The Held-To-Maturity Trap: Lakeland Bancorp Vs. Camden National

How banks account for their assets can have profound effect on their ability to weather today’s down market for banks.

Voodoo Mine Control: Nouveau Monde Graphite (NMG)

Newly “critical minerals” will profoundly alter society’s relationship with the ancient practice of mining.

The Strange Case for “TweetBonds”

Twitter might be privately owned by a brash, care-nothing billionaire. But, with a bit of digging, various forms of credit tied to the company still can be bought and sold. Meaning, even the worst day for Elon Musk but be the best for investors.

Above It All: Planet Labs (PL)

The world’s second oldest profession — spying, that is — is getting a makeover from above. A new generation of imaging and data satellites is bringing top-shelf intelligence to just about anybody.

Movies like The Bourne Identity is NOT the way to think about it.

Truck Stops Detour Around the Service Worker Shortage: TravelCenters of America (TA)

The American labor force will probably never return to its pre-pandemic structure. New forces are driving the American service economy and creating some unlikely winners. Case in point: TravelCenters of America.

Is The “Carvana of Steaks” Private Equity Gold?

Meat processing in the United States is going through a fundamental restructuring. A properly funded start-up could disrupt the $1 trillion global business in beef, chicken, and fish.