Public Storage (PSA) Hoards the REIT Market

Photo by Michael Porter via Pexels

uncertainty and recession concerns drive demand for self-storage

Internet cloud storage might be on the outs with investors. But physical self-storage facilities appear to be fitting right in, thanks to publicly traded real estate investment trusts (REITs).

Public Storage (PSA) is the industry leader with $3.5 billion sales, $589,000 in revenue per employee, and $53.9 billion in total market capitalization.

“My business is all about people managing changes in their lives,” said a self-storage facility owner in rural Maine. The former dairy farmer says switching from storing cows for storing people’s belongings proved to be a smart business choice.

“With so much change going on in the world, I kind of feel bad for what I can charge for what’s really just an extra room.”

Self-storage units – along with student housing and medical office space – have long been seen as the “three shining stars” of real estate. That is, the rare properties that offer safe havens during a downturn. Researchers estimate roughly 10% of the 142 million U.S. households regularly pay for self-storage. The sector is driven by downsizing or defaulting on homes and businesses. Divorce and deaths spike usage. Storing construction equipment is particularly popular.

Rental fees can be rich. Even simple self-storage units can fetch $8 to $12 per square foot annually. That runs about double the national averages for warehouse space. And in crowded urban areas, it’s not unusual for self storage facilities to capture $25 per square foot.

Profits can be easy to store. A concrete box with a metal roof needs few capital improvements. No sales agent charges a commission. There’s not much for the tax assessor to value. Contractors can’t charge premiums for the simple materials and skills needed.

Annual returns of 15% to 20% are considered reasonable, at least historically.

Large self-store REITs, like Public Storage, tell an attractive story in uncertain times for consumers and businesses.

Self-Storage Complexity

However, managing even a simple 12-by-14–foot storage closet is more complex than it appears. Setting rental rates requires complex discounting schemes that factor facility size, distance from loading doors, parking, and climate control. The Web might make heroes of the stars of like Storage Wars, but disposing of abandoned goods is surprisingly tricky. Collecting from defaulting customers is not simple, either. Hedging disasters like flooding, theft, and fire are costly. Competition can be fierce. Infrastructure, roads, and demographics all affect profit.

Yet history shows self-storage facilities may be recession-resistant. But they are far from recession-proof. The cost of capital plays a critical factor. Rent increases turn out to be rather moderate compared to pure commercial real estate. AnythingResearch reported that the average revenue per self-storage firm dropped 8% in 2010.

The firm is calling for another contraction in sales 2026.

Professionally managed real estate investment trusts have long track records in managing the complexity of self-storage, though they limit investor access to the tax benefits and depreciation of direct ownership. CUBESmart (CUBE), Extra Space Storage (EXR), and Life Storage Inc. (LSI) feature reasonable returns over time. Some offer dividends. Self-storage exposure can also be found in exchange-traded funds.

And for those who seek adventure, there are odder self-storage vehicles. SmartStop, a Ladera Ranch, Calif.-based self-storage operator, claims to be the largest public so-called “non-traded” self-storage REIT. SmartStop registers with regulators like the SEC, but its stock does not actively trade on public exchanges. Rather, shares are bought and sold by appointment on private exchanges.

SmartStop tries to be “private-ish” equity, with a shade more liquidity and far less hallucinatory valuations.

But dangerous times make for simpler choices: All indications are that the market leader in the sector, Glendale Calif.-based Public Storage, is the self-storage story to know. The operation was dinged recently when markets rolled back valuations on less-than-expected earnings and inflation concerns. The stock is trading at a 52-week low of about $300.

But while the bad news is true, it misses the long-term positive message.

Public Storage’s operation is both big and efficient. It captures 55 cents of operating profit for every dollar of sales. That’s serious logistics for a firm with about 3,000 locations in the U.S. and Europe. The stock has outperformed indexes by around 10 percent over the past 12 months.

Public Storage has locked in ten year’s worth of capital spending …

But what makes Public Storage compelling is the cash the operation can be expected to capture over the next decade. The self-storage world likes to value itself on so-called funds from operations, usually dubbed as FFO in print, or “ef-ef-oh” in the spoken world. Basically, FFO is operating cash flow with the effect of asset sales or interest income backed out. FFO is the cash a real estate operation actually threw off. Not the money harvested from a particular sale or loan from a property.

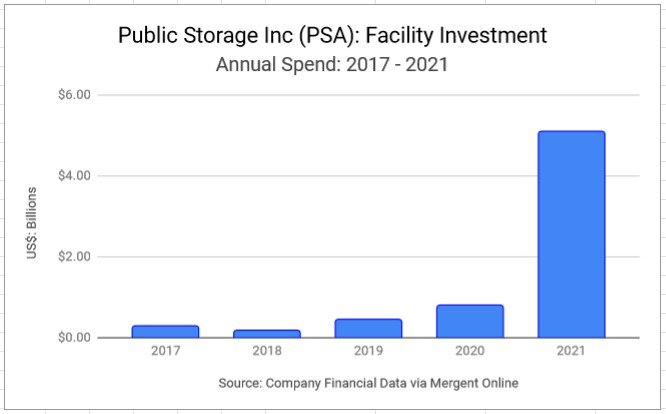

Without question, Public Storage is telling a rock solid FFO story. The company has gone on an unprecedented borrowing and investing spree. In 2021 alone, the operation laid down a cool $5.1 billion bet on investments in storage facilities and other capacities.

That’s roughly almost 10 times the average annual investment over the previous half decade.

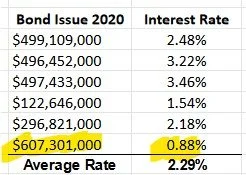

Capital cycles in real estate run in roughly 10-year periods. Public Storage appears to have locked in historically low costs of capital for that entire business cycle. For example, of $2.5 billion in bonds floated in 2020, the average cost of that capital is well below 3%.

… at an time low cost of capital.

A breakdown of that borrowing shows that $607 million had an interest rate of just .88%. That’s eighty eight basis points!

Public Storage has shown a consistent return-on-investment of about 13%. There’s just $.80 of debt for every dollar of equity in the company’s balance sheet. It’s hard to imagine how profit won’t find its way to this company’s bottom line.

Is it really such a leap that in these uncertain times, returns can be found in betting on the real assets that 310 million Americans will need to store their stuff? They, like us, are simply hunkering down and waiting for a better world.